Zhang Jun, Dean, School of Economics, Fudan University

Apr 22, 2025

There are signs that the Chinese economy has been improving, owing to the government’s September 2024 stimulus package. Year-on-year GDP growth in the first quarter of this year reached 5.4% – continuing the marked acceleration from the third quarter of last year.

Ghulam Ali, Deputy Director, Hong Kong Research Center for Asian Studies

Apr 16, 2025

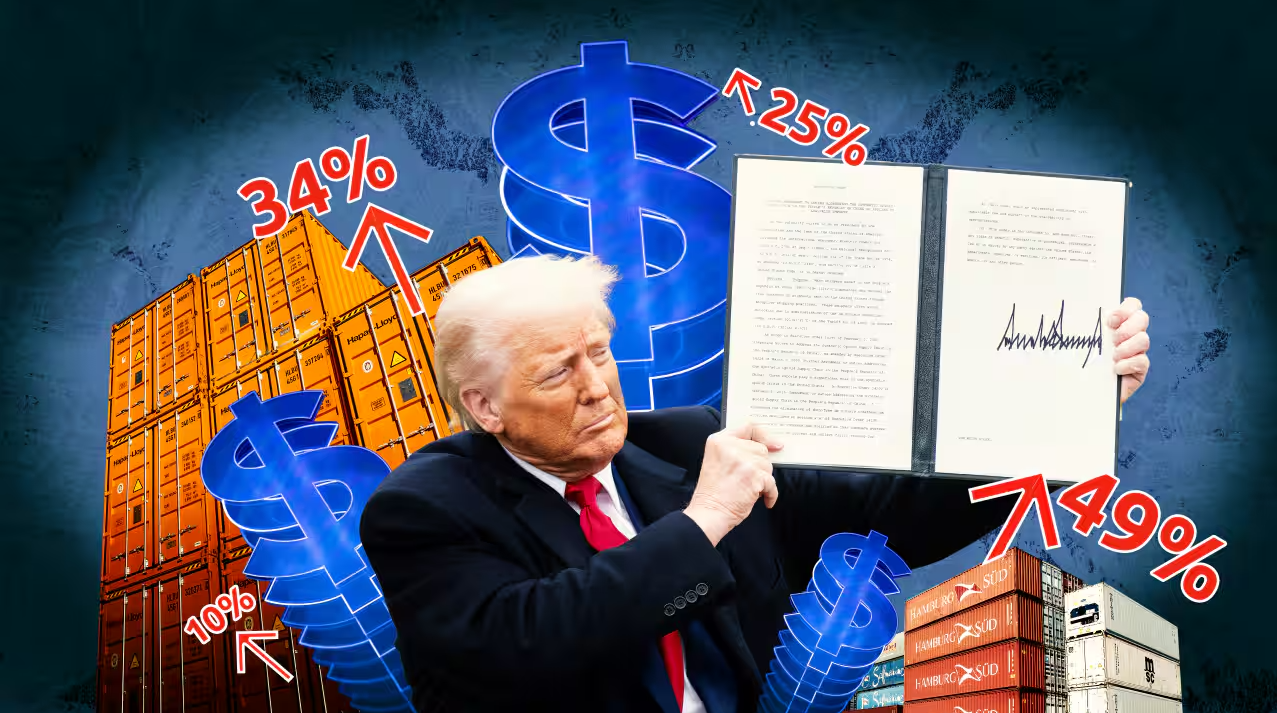

His poorly conceived global tariff war will severely affect U.S. consumers, increase inflation, damage America’s reputation as a reliable partner and put the entire global trade system and practices that the U.S. once championed at risk.

Huang Yiping, PKU Boya Distinguished Professor and Former Member of the Monetary Policy Committee, People’s Bank of China

Apr 14, 2025

US President Donald Trump’s “Liberation Day” announcement of sweeping new tariffs on imports from more than 180 countries will be remembered as a man-made economic tsunami. Many are already comparing it to President Herbert Hoover’s 1930 Smoot-Hawley Tariff Act, which slashed global trade by 66% in five years and deepened the Great Depression. Trump’s tariffs – most of which have been abruptly paused for 90 days – have rattled financial markets, prompting analysts to warn that the United States could enter a recession in 2025.

Wang Yuzhu, Research Fellow, Institute for World Economy Studies, SIIS

Apr 11, 2025

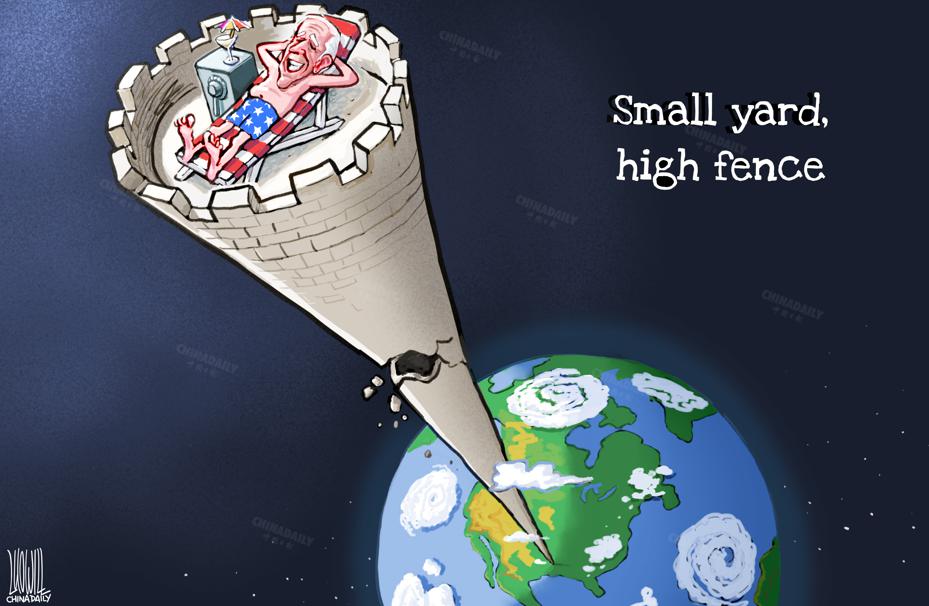

A broad vision is necessary if the United States wants to bring industry back home. The time has come for the it to reconcile its ambitions with on-the-ground realities. Washington should develop a sustainable strategy for managing relationships with other major powers, especially China.

Yu Xiang, Senior Fellow, China Construction Bank Research Institute

Apr 09, 2025

Donald Trump might briefly bend the rules of economics, but their core endures. Tariffs could spark a U.S. manufacturing revival, but it will be fleeting. And the fallout — higher costs of living, strained global ties and a fractured world economy — seems all but certain.

Dan Steinbock, Founder, Difference Group

Apr 05, 2025

After a decade of deglobalization and U.S. geopolitics, globalization is no longer at crossroads, but unraveling. The longer this plunge prevails, the greater will be its costs.

Stephen Roach, Senior Fellow, Yale University

Mar 31, 2025

The world’s major growth engines are about to run in reverse. The policies and uncertainties of US President Donald Trump’s second administration have hit a sluggish global economy with a transformational exogenous shock. Risks are especially worrisome in both the United States and China, which have collectively accounted for a little more than 40% of cumulative global GDP growth since 2010.

He Weiwen, Senior Fellow, Center for China and Globalization, CCG

Mar 31, 2025

Global GDP is likely to shrink again in Q2. Inflation will rise, and real pain will start to set in. Key industries will be disrupted, dragging down production and consumption. The United States may miss its growth target for 2025, and as a new cross-Atlantic trade war looms, growth may slow in the eurozone as well.

Zhou Xiaoming, Former Deputy Permanent Representative of China’s Mission to the UN Office in Geneva

Mar 31, 2025

A great many negative consequences would follow a successful effort by the United States to pull the MFN rug out from under the world’s second-largest economy. If this key pillar of global trade is taken away, the collapse of the WTO itself could follow.

Zhang Monan, Deputy Director of Institute of American and European Studies, CCIEE

Mar 20, 2025

The introduction of reciprocal tariffs represents a pivotal shift in U.S. trade policy. The move from multilateral trade engagements to bilateral or regional agreements is a strategic effort to redefine international trade and ultimately give the United States an advantage.