Media Report

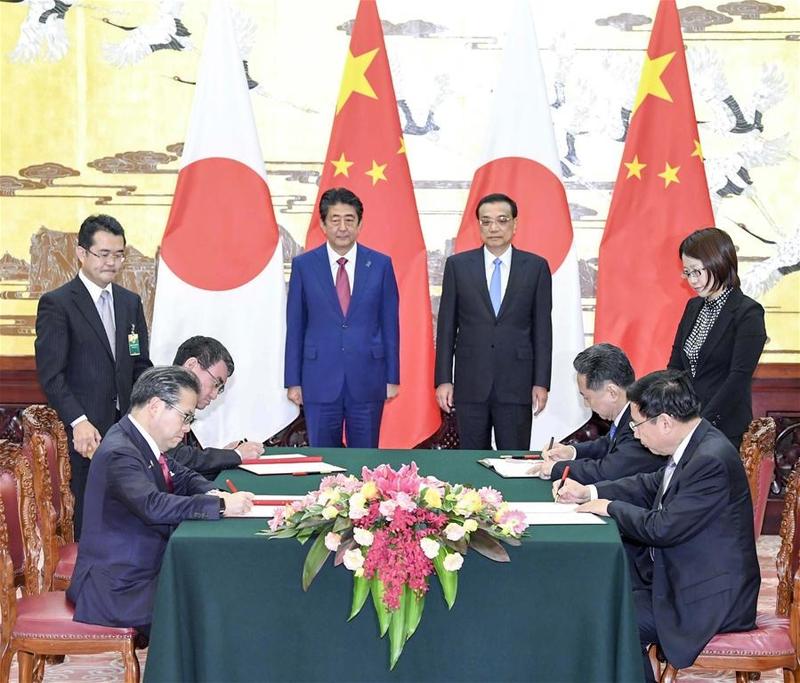

- The New York Times reports: "It has been eight years since China overtook Japan as the world's second-largest economy. Yet the Japanese government continued to provide China with development assistance usually reserved for poorer countries. Until now. In Beijing for the first official visit by a Japanese leader since 2011, Prime Minister Shinzo Abe acknowledged China's economic dominance by announcing an end to the aid. Instead, he pledged to forge deeper economic and political cooperation, in what is widely seen as a hedge against the volatile, America-first policies of President Trump. The announcement — coupled with new cooperation agreements Mr. Abe signed on Friday with his Chinese counterpart, Li Keqiang — signaled a significant shift in a relationship that has been haunted by war and occupation and is still strained by territorial disputes and other issues, which, publicly at least, have receded into the background."

- Bloomberg reports: "After a quiet few weeks, the yuan is center stage again. The currency slid toward its weakest in a decade on Friday, approaching a key support level of 7 per dollar before managing a slight rebound. The moves came after it fluctuated in a narrow band of about 1 percent through October, the tightest range since April 2017. Now bearish wagers are building again as capital outflow pressure grows."

- The Wall Street Journal reports: "The U.S. is home to more dollar-based billionaires than any other country but China has cut into its lead, according to Swiss bank UBSGroup AG's annual report card on the state of the megarich. Overall, global billionaire wealth increased by a record $1.4 trillion to $8.9 trillion in 2017, a year in which economies around the world grew at robust rates, equity markets soared and bond yields stayed low as central banks mostly maintained easy-money policies in an environment of low inflation. The financial backdrop has been less supportive this year, as global equity markets are mostly down on the year and bond yields have risen. But billionaires' wealth is likely to rise further this year. Much of the riches generated by billionaires come from their own businesses and not the financial markets, UBS noted. U.S. tax cuts that went into effect this year will likely also have an impact."

Calendar

- 2018-10-25 China Mocks Report It Tapped Trump’s iPhone (and Plugs Its Own Competitor)

- 2018-10-24 Japan and China, Asian Rivals, Are Trying to Get Along

- 2018-10-23 China Officially Launched the World's Longest Sea Bridge Linking Hong Kong and Macau to the Mainland

- 2018-10-22 China's battered stock market just had its best day in years

- 2018-10-21 China's slowing economic growth should not be a concern

- 2018-10-19 Mike Pompeo Warns Panama Against Doing Business With China

- 2018-10-18 China’s weak currency is helping it in the trade war — but Beijing doesn’t want it to fall further

- 2018-10-17 Trump Opens New Front in His Battle With China: International Shipping Image

- 2018-10-16 $6 trillion of local government debt may be lurking under the surface in China

- 2018-10-15 Blame the U.S. for the Weaker Chinese Currency

News

- The New York Times Shinzo Abe Says Japan Is China's 'Partner,' and No Longer Its Aid Donor

- Bloomberg China's Yuan Nears Decade Low as Brief Period of Calm Ends

- The Wall Street Journal U.S. Leads the Way in the Billionaires Race—but China Is Catching Up

- The New York Times As China Rattles Its Sword, Taiwanese Push a Separate Identity

- CNN Net-A-Porter turns to Alibaba to sell more $2,500 bags in China

- Fortune Trump's Bailout of U.S. Farmers Hit by His Trade War With China? It May End Up Aiding a Giant Chinese Company

- The Wall Street Journal China, Japan Push for Free Trade as Both Grapple With Trump Demands

- NPR 14 Children Injured In Knife Attack At Kindergarten In China

- Reuters China's Hebei to ensure clean coal supply for 2018-2020 winters

- CNBC Military tensions around Taiwan could make it harder to resolve the trade war

- CNN China says it will do battle with speculators betting against its currency

Commentary

- The Guardian The Guardian view on China's detention camps: now we see them

- The Wall Street Journal How to Win a Cold War With Beijing

- Bloomberg Depressed by China Stocks? Booze and Drugs Won't Help

- CNN China may wait it out rather than deal with Trump