Media Report

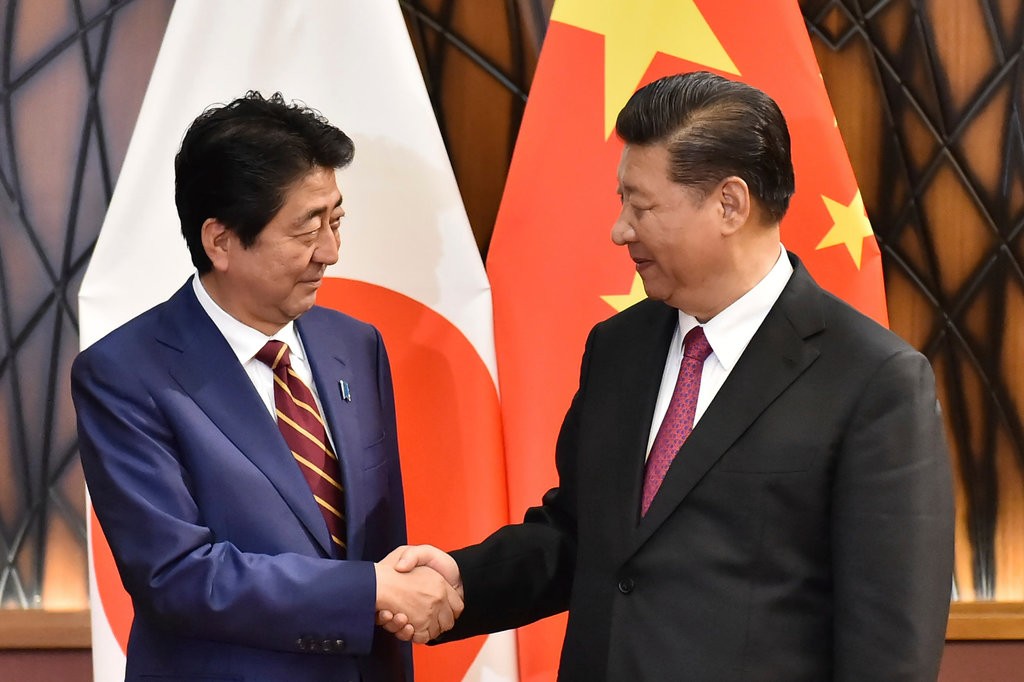

- The New York Times reports: "Six years ago, angry demonstrators filled the streets in dozens of Chinese cities to protest Japan's claim to islands in the East China Sea, surrounding Tokyo's embassy, overturning Japanese cars and in some cases even attacking sushi restaurants. Two years later, President Xi Jinping met with Prime Minister Shinzo Abe on the sidelines of a regional conference in Beijing, and the body language said it all: Mr. Xi could barely muster a smile during an awkward handshake for the cameras (...) But in the age of Trump, both are looking for a little more normality. Battered by plummeting relations with Washington, and particularly by President Trump's trade war, Mr. Xi is looking to a friendlier Japan as a hedge. And though Mr. Abe has met more often with Mr. Trump than any other foreign leader has, he is well aware of the president's fickle treatment of American allies and also wants to cover his bets."

- CNBC reports: "The Chinese yuan is expected to weaken further in the next six months, a Goldman Sachs analyst said on Wednesday. Timothy Moe, co-head of Asia macro research, said the bank expects China's currency to "pop over" the psychological barrier of 7 per dollar, to reach 7.1 in the next six months. The currency pair is trading at around 6.94 as the yuan has declined by 6 percent against the greenback year-to-date. 'It's probably unlikely to happen before the end of the year because ... 7 seems to be the short-term line in the sand ... The U.S. is looking at that figure — and probably a bit above — as evidence that might support allegations of currency manipulation,' Moe told CNBC's 'Squawk Box.'"

- The Wall Street Journal reports: "Chinese videogame companies, battered by a halt in new-game approvals, are expecting the freeze to stretch into next year in a blow for a sector that was recently a money spinner. Regulators haven't greenlighted the sale of new titles since March, when a government reorganization started. Game companies expected approvals to resume this month, following the completion of the shuffle. After months of lobbying officials for answers, the realization is setting in among game-company executives that approvals won't resume soon (...) The regulatory standstill in the world's biggest videogame market has cost game companies roughly $1.4 billion, or about $200 million a month, in lost revenue, said Joost van Dreunen, head of games analyst firm SuperData Research Inc.

Calendar

- 2018-10-23 China Officially Launched the World's Longest Sea Bridge Linking Hong Kong and Macau to the Mainland

- 2018-10-22 China's battered stock market just had its best day in years

- 2018-10-21 China's slowing economic growth should not be a concern

- 2018-10-19 Mike Pompeo Warns Panama Against Doing Business With China

- 2018-10-18 China’s weak currency is helping it in the trade war — but Beijing doesn’t want it to fall further

- 2018-10-17 Trump Opens New Front in His Battle With China: International Shipping Image

- 2018-10-16 $6 trillion of local government debt may be lurking under the surface in China

- 2018-10-15 Blame the U.S. for the Weaker Chinese Currency

- 2018-10-14 'You tell me': China ambassador stumped on who aids Trump on trade

- 2018-10-12 China’s trade surplus with the U.S. hit a record $34.1 billion in September amid trade war

News

- The New York Times Japan and China, Asian Rivals, Are Trying to Get Along

- CNBC The Chinese yuan is going to get weaker in the next 6 months, says Goldman Sachs

- The Wall Street Journal China's Pause on Videogame Approvals Expected to Drag Into Next Year

- Bloomberg China's Squeezed Private Companies Face More Funding Pain

- CNN China's government is trying to hijack a viral meme for propaganda

- Variety 'The Monkey Prince' Hatched by China's Bona and Japan's Toei Animation

- Forbes China's Top Selfie Touch-Up App Isn't Looking So Pretty For Investors

- CNN Ford is hiring an industry veteran to save its China business

- Fox Business Tesla could manufacture 250K vehicles annually in China

- CNBC Chinese media accuse Trump of playing 'high-stakes game' in the Taiwan Strait

Commentary

- The New York Times The Pope Doesn't Understand China

- Bloomberg China's Gaming Green Channel Was Just a Loophole

- The Wall Street Journal Let's Vote on a China Cold War

- The New York Times How Trump Should Address Unfair Trade With China

- The Wall Street Journal A Naval Message for China

- The New York Times Being China Means Never Having to Say You're Sorry

- The National Interest China's Air Force Has One Big Problem It Can't Seem to Solve