Media Report

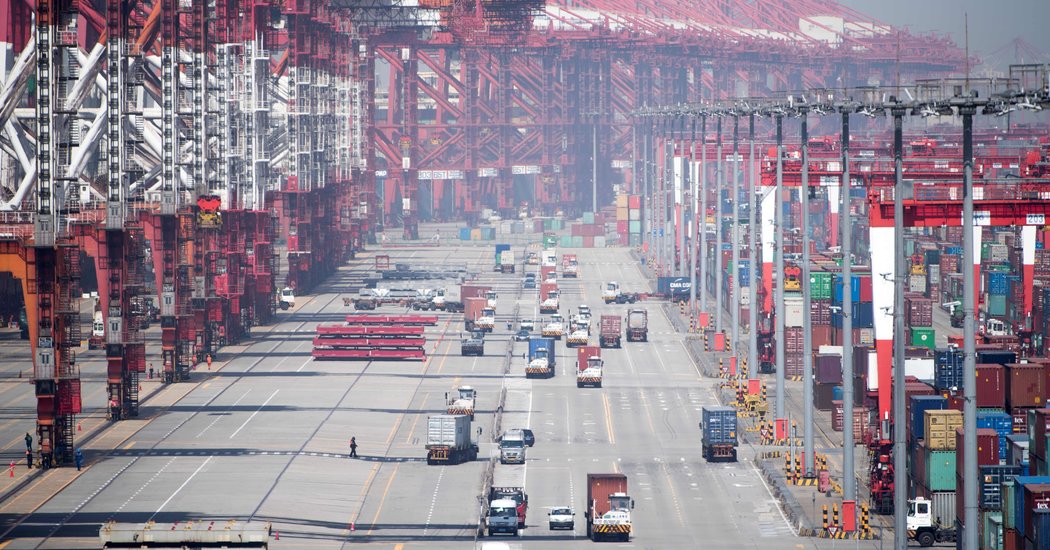

- The New York Times reports: "As the United States and China prepare to resume fractious trade talks this week, executives from American companies flocked to Washington on Monday to warn the Trump administration that imposing tariffs on an additional $200 billion worth of Chinese goods would cripple their businesses and raise prices on everything from bicycles to car seats to refrigerators. Dozens of companies voiced concerns to trade officials during the first of six days of hearings on the administration's plan to impose tariffs of as much as 25 percent on a wide array of Chinese imports... While the companies appearing before the government panel varied widely, their concerns struck a similar theme: The United States is no longer equipped to produce many materials that they depend on for their products."

- The New York Times reports: "In the world's most vital maritime chokepoint, through which much of Asian trade passes, a Chinese power company is investing in a deepwater port large enough to host an aircraft carrier. Another state-owned Chinese company is revamping a harbor along the fiercely contested South China Sea. Nearby, a rail network mostly financed by a Chinese government bank is being built to speed Chinese goods along a new Silk Road. And a Chinese developer is creating four artificial islands that could become home to nearly three-quarters of a million people and are being heavily marketed to Chinese citizens. Each of these projects is being built in Malaysia, a Southeast Asian democracy at the heart of China's effort to gain global influence."

- CNBC reports: "Property is the biggest risk in the next 12 months, much greater than the trade war, according to Larry Hu, head of greater China economics at Macquarie. Last week, Nanjing, a tier two city, announced a ban on corporate purchases of residential properties, following similar moves to limit speculation by Shanghai and some other cities. However, the public still expects property prices will increase because the government has constantly switched between tightening and easing policies, often to prevent a drop in growth, according to a report co-authored by Sheng Songcheng, a counselor to the People's Bank of China."

Calendar

- 2018-08-20 China Trade War: Where Are We Now?

- 2018-08-17 US-China trade talks will focus on yuan weakness, experts say

- 2018-08-16 China: Trade talks with the US are back on

- 2018-08-15 China could reportedly use its ‘unwritten’ tech rules as an ‘invisible tool’ against US firms

- 2018-08-14 China’s Growth Engine Sputters as It Battles U.S. Over Trade

- 2018-08-13 China is printing money for countries like Poland and Brazil at 'full steam'

- 2018-08-10 China paper blasts report about rifts in Beijing's leadership, says 'an elephant can't hide'

- 2018-08-09 How China Wins the Trade War

- 2018-08-08 Trump’s Tariffs Are Changing Trade With China. Here Are 2 Emerging Endgames. Image

- 2018-08-07 Beijing 'will not surrender' to US 'trade blackmail,' Chinese media says

News

- The New York Times 'We Cannot Afford This': Malaysia Pushes Back Against China's Vision

- CNBC Asia markets trade mostly higher as investors look ahead to US-China trade talks this week

- The New York Times El Salvador Recognizes China in Blow to Taiwan

- BBC News Trump accuses China of 'manipulating' its currency

- CNBC S&P 500 touches all-time high, ties record for longest bull market

- The New York Times Companies Warn More China Tariffs Will Cripple Them and Hurt Consumers

- CNBC China's biggest risk may be its property market — not the trade war

- CNN Mahathir tones down anti-China rhetoric during visit to Beijing

- Reuters China defies U.S. pressure as EU parts ways with Iranian oil

- Vox It's not just Russia. China, North Korea, and Iran could interfere in 2018 elections, too.

Commentary

- National Interest 7 Signs that China's Military is Becoming More Dangerous

- The Wall Street Journal Corruption Currents: China Shifts to Iranian Tankers to Keep Buying Oil

- The National Interest Can America Defeat China's Asymmetric Warfare Plans if Conflict Came?

- Inside Higher Ed The Challenges of Creating World-Class Universities in China

- Wired Airbnb Wants to Find a Home in China

- Forbes Blunt Advice To U.S. Tech Businesses About China's Rising Clout