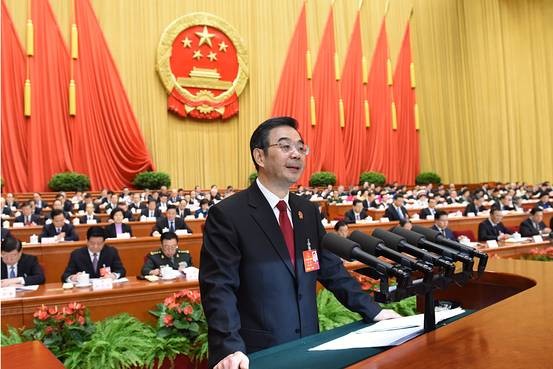

- CNN reports China will create an international maritime judicial center to protect its national sovereignty and maritime rights, the country's Supreme People's Court said Sunday, according to state news agency Xinhua.The move comes as tensions rise in the South China Sea, where China is locked in long-standing maritime disputes with several countries. The report gave few details on how the center would operate but said courts across the country would work to make China into a "maritime power." "We will resolutely safeguard national sovereignty, maritime interests and other core interests," said Zhou Qiang, China's chief justice. China has declined to participate in a case brought by the Philippines at the Permanent Court of Arbitration in the Hague. The suit was first brought by the Philippines in 2013 to settle maritime claims in the South China Sea but China has refused to participate. A ruling is expected in May. Chinese Foreign Minister Wang Yi said at a news conference Tuesday that China was fully in line with the law for not accepting the arbitration.

Wall Street Journal reports that Chinese regulators are speeding up ways to help banks shed bad loans, but some of the measures risk keeping "zombie" companies afloat while making lenders even more strapped for capital. The deepening economic slowdown has heightened the need for banks to have more funds to lend out. A main feature in a plan outlined by central-bank and regulatory officials over the weekend would be to let banks sell dud loans to investors either by repackaging them as securities or transferring them to special asset-management companies that handle distressed debt. Senior executives at China's Big Four state-owned banks say regulators are also exploring ways for banks to exchange bad loans for equity in certain too-big-to-fail companies—a potentially controversial step that they say could saddle banks with near-worthless stock and squeeze their liquidity. Bank of China Ltd., one of the top four lenders, recently agreed to become the largest shareholder in a publicly traded shipbuilder under the yet-to-be-disclosed plan, people close to the bank say. Officials at the central bank and banking regulatory agency declined to comment.

Wall Street Journal says that China's government is prioritizing consolidation over bankruptcies in reorganizing state companies, a senior official said, suggesting a go-slow approach in an effort seen as key to revitalizing the slowing economy. Xiao Yaqing, director of the powerful government commission that oversees state assets, said his agency will protect workers' rights as it balances competing interests in reforming the state sector. China "won't experience a wave of layoffs" as seen in the late 1990s, Mr. Xiao said at a news conference Saturday, referring to an earlier period of restructuring when tens of millions of state workers lost their jobs. Mr. Xiao praised progress made to date in reorganizing the state firms that tower over the economy in diverse strategic sectors such as oil, banking, telecommunications and more. Over the past year, the government engineered the merging of 12 big state firms into six entities, mostly in energy and transportation, and Mr. Xiao said his agency would press ahead with "more mergers and acquisitions" in the state sector while de-emphasizing bankruptcies.

- 2016-03-11 China says slowing economy won’t stop anti-pollution efforts

- 2016-03-10 Awash in Empty Homes, China Asks Migrant Workers to Settle Down

- 2016-03-09 China says takes 'distinctly Chinese approach' to national security

- 2016-03-08 China, South Korea step up sanctions on North Korea

- 2016-03-07 China vowed to peak carbon emissions by 2030. These researchers think it could already be there.

- 2016-03-06 China Seeks to Balance Stimulus and Reform

- 2016-03-04 China's 2016 Defense Budget to Slow in Line with Economy

- 2016-03-03 Five Things to Know About China’s ‘Two Sessions’

- 2016-03-02 China testing Obama as it expands its influence in Southeast Asia

- 2016-03-01 Exclusive: China to lay off five to six million workers, earmarks at least $23 billion

- Financial Times Extradition battle looms over US-China relations

- Forbes Moody's Negative Outlook on Hong Kong: Form over Substance

- New York Times Chinese Owner of Waldorf Astoria Bets Big on More US Hotels

- The Washington Post Lin Dan wins his 6th All England badminton title

- Bloomberg China Pledges Greater Effort to Crackdown on Financial Crime

- Reuters China's electric cars sales to double in 2016: minister

- The Washington Post Demanding pay, Chinese miners protest over governor's claim

- Reuters China's top judge says large jump in terrorism convictions

- New York Times China Pledges New Push Against 'Hostile Forces,' Separatists

- Reuters China securities regulator: won't re-introduce circuit breaker in next few years

- The Washington Post China's central banker says economy can hit growth target

- Bloomberg Hong Kong's Tsang Defends Economy After Moody's Debt-Outlook Cut

- Bloomberg Boeing Delivered a Record 200 Jetliners to China Last Year

- Forbes Can Shanghai Disneyland Survive China's Downturn?

- Bloomberg China's Growth Target Is the Next Test for Its Central Bank

- Forbes China's Banks Selling Their Bad Loans Won't Solve The Problem

- blogs.wsj.com Writing China: David Shambaugh, 'China's Future'

- The Guardian China's ski industry is set to soar following Olympic win

- foreignpolicy.com Can China Avoid the Middle Income Trap?