Media Report

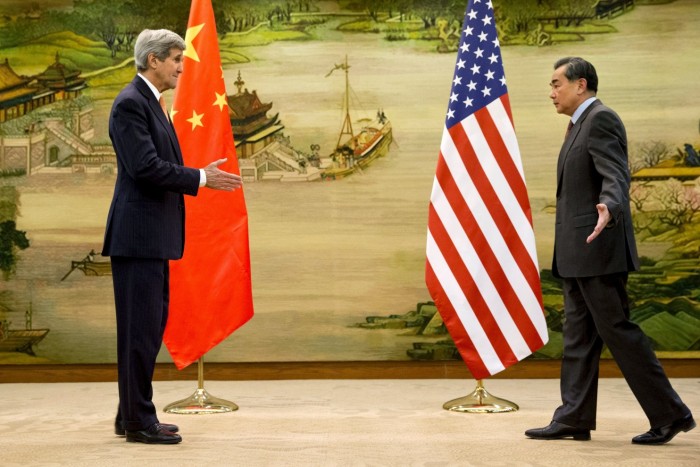

- The Washington Post reports: "Secretary of State John F. Kerry and China's foreign minister agreed Wednesday to move ahead with a U.N. resolution condemning North Korea for its latest nuclear test, but they appeared as far apart as ever on how far to push Pyongyang. The United States says any additional U.N. action against the North is likely to include greater sanctions. Beijing, a critical ally for North Korea, was angered by the nuclear test earlier this month but has not indicated whether it would endorse further pressures....In Beijing, analysts and government media outlets argue that pushing North Korea further could make it more aggressive or hasten the regime's collapse, setting off a wave of refugees streaming into China and potentially installing a U.S. client state on its border."

- Reuters reports: "China's highly volatile shares ended lower again on Wednesday after plunging on Tuesday, taking losses in 2016 to about 22 percent or 12 trillion yuan ($1.8 trillion)....China markets began the year with precipitous falls and a sharp depreciation in the yuan currency, and selling pressure has persisted as economic data confirmed slowing growth and deteriorating business conditions, hammering confidence in stocks....Four listed companies suspended trading in their shares on Wednesday, saying major shareholders who had pledged shares as collateral faced margin calls and would seek ways to avoid forced liquidation....Beijing intervened to stem that rout and orchestrate a recovery of sorts, but anyone who mistook that for a bottom and bought back in is nursing losses again."

- CNBC reports: "Apple began to see "some signs of economic softness" in its Greater China region earlier this month, according to CEO Tim Cook....When the company announced its fiscal year fourth quarter earnings in October, Cook said the company had seen 'no sign of a slowdown in China,' reporting that greater China revenue rose 99 percent year over year to $12.52 billion. That figure represented a 5 percent decrease from the previous quarter. Ahead of Tuesday's quarterly report, experts said they worried weakness in the Chinese economy could stifle demand for the profit-driving iPhone."

Calendar

- 2016-01-26 China Stocks Plunge to 13-Month Low Amid Capital Outflow Concern

- 2016-01-25 John Kerry in Asia to Press China on North Korea Nuclear Test, South China Sea

- 2016-01-24 Kerry to Press China Over North Korea, Urge ASEAN Unity Over South China Sea

- 2016-01-22 Falling Pollution from China Could Hasten Peak Carbon

- 2016-01-21 Survey of U.S. companies in China finds that not all's well

- 2016-01-20 Capital Flight from China Worse Than Thought

- 2016-01-19 Xi Asserts China's Middle East Role as Iran Sanctions Lifted

- 2016-01-18 China GDP Growth Slowest Since 1990

- 2016-01-17 China's economic turmoil sends ripples of anxiety across G20

- 2016-01-15 Ousted Communist Official’s Brother Is Living in United States, China Says

News

- The Washington Post China backs U.N. move to denounce North Korea over nuclear test

- Reuters China shares end lower, taking 2016 losses to $1.8 trillion

- CNBC Apple begins to see signs of 'softness' in China

- The Washington Post Pursuing critics, China reaches across borders. And nobody is stopping it.

- The Wall Street Journal John Kerry Arrives in Beijing After Push to Urge Regional Unity on South China Sea

- Financial Times Beijing 'unimpressed' by Danny Alexander's nomination for Asian Infrastructure Investment Bank

- The New York Times China Urging Afghanistan to Restart Peace Talks With Taliban

- TIME Swedish Activist Peter Dahlin Concerned Over Colleagues In Chinese Prisons

- NPR China's Great Wall Is Crumbling In Many Places; Can It Be Saved?

- Bloomberg Business China's $1 Trillion Money Exodus Isn't About Capital Controls

Commentary

- The Guardian The day Zhao Wei disappeared: how a young law graduate was caught in China's human rights dragnet

- Bloomberg View Free Trade With China Wasn't Such a Great Idea for the U.S.

- The Wall Street Journal: China Real Time George Soros in China's Crosshairs After Predicting Tough Economic Times Ahead

- The New York Times Inquiry in China Adds to Doubt Over Reliability of Its Economic Data

- Foreign Policy: Tea Leaf Nation China's New Grand Strategy for the Middle East

- The Wall Street Journal: China Real Time China GDP Growth Could Be as Low as 4.3%, Chinese Professor Says

- The National Interest Get Ready, America: Russia and China Have Space Weapons