List Diplomacy

List DiplomacyOn the sidelines of the G20 meetings, Chinese State Councilor and Foreign Minister Wang Yi held talks with U.S. Secretary of State Antony Blinken. During more than five hours of talks, the two parties discussed U.S.-China relations, as well as issues of mutual interest.

The Chinese delegation described the mounting challenges facing the U.S.-China relationship and complained that the U.S. is fomenting a feeling of China-phobia. During the meeting, Wang Yi raised four major "outstanding problems" in the relationship.

"We hope the U.S. side can take China's lists seriously," Chinese Foreign Ministry spokesperson Wang Wenbin said Monday. "The lists once again demonstrate China's serious position that the U.S. must stop exercising containment and suppression, stop interfering in China's internal affairs, and stop undermining China's sovereignty, security and development interests."

The U.S. delegation focused on China's support for Russia's invasion of Ukraine, warning of consequences, including sanctions, should China offer material support for the war.

"I shared again with the state councilor that we are concerned about the PRC's alignment with Russia," said Blinken. He added that he did not think China was behaving in a neutral way as it had supported Russia in the United Nations and "amplified Russian propaganda."

Read more in "Still Talking Past Each Other," by David Shambaugh, a Gaston Sigur Professor of Asian Studies and Director of the China Policy Program at George Washington University.

Going All Out

Going All OutChina reported its worst economic performance since the beginning of the COVID-19 pandemic on Friday, according to the National Bureau of Statistics. As China continues to battle the pandemic, China's Premier Li Keqiang singled out Shanghai, Guangdong, Jiangsu, Zhejiang and Fujian to lead China's economic recovery, which is "still unstable." He also highlighted the risks of imported inflation as the economy recovers, stressing that grain and energy supplies are key to keeping prices in check.

Officials must "handle multiple difficulties properly to stabilize growth as well as controlling inflation, with attention to be paid to preventing imported inflation," Mr Li said, according to a report from the Xinhua news agency. Talking with entrepreneurs and fresh college graduates, he said China should encourage mass entrepreneurship and innovation by inspiring more people, especially the youth, to start businesses and innovate.

Whereas the U.S. central bank is aggressively tightening monetary policy, China is going back to its old playbook of stimulus via public investment, readying 7.2 trillion yuan ($1.1 trillion) in funds available for infrastructure spending. China is weighing a massive fiscal stimulus in the form of a fast-track sale of special bonds. If it happens, the sale of 1.5 trillion yuan — about $220 billion — in local government bonds would be unprecedented and reflect the growing concern over China's economy.

President Xi Jinping has called for an "all out" effort to increase infrastructure spending this year in the hope of fueling economic growth and meeting a GDP growth target of around 5.5%.

A Mountain of Debt

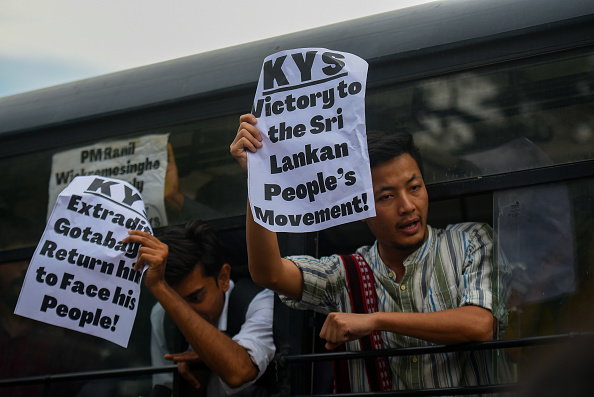

A Mountain of DebtWith around $35 billion in foreign debt, Sri Lanka's sovereign-debt crisis has crippled its economy, plunging the nation into chaos with months of political turmoil and public unrest. The anti-government demonstrations took a dramatic turn this week, leading President Gotabaya Rajapaksa to resign and flee the country, leaving an all-party government tasked with restoring economic order, negotiating a debt restructure with creditors, and progressing talks with the International Monetary Fund for financial relief.

But some critics are pointing to China as a cause of the sovereign-debt crisis, suggesting that China's generous lending to Sri Lanka fueled the current financial and political crisis in the country.

As Sri Lanka's foreign-exchange reserves began to dwindle under a mountain of debt early in the Covid-19 pandemic, some officials suggested it was time to ask for a bailout from the IMF. China, Sri Lanka's largest single creditor, suggested the nation keep adding on new debt to pay off the old, according to current and former Sri Lankan officials. Sri Lanka accepted the offer, and $3 billion in new credits poured in from Chinese banks in 2020 and 2021. Now, the country has run out of U.S. dollars to pay for imports of basic goods, leaving citizens waiting for hours to buy fuel and major cities struggling to keep the lights on.

But despite past issues, Sri Lanka is continuing negotiations with China for as much as $4 billion in aid and is "confident" Beijing will agree "at some point," according to a top envoy.

In the meantime, U.S. Treasury Secretary Janet Yellen said she would pressure China to restructure loans to countries that face unsustainable debt burdens during the meeting of finance ministers from the Group of 20 major economies this week.

Prepared by China-US Focus editorial teams in Hong Kong and New York, this weekly newsletter offers you snap shots of latest trends and developments emerging from China every week, while adding a dose of historical perspective.

- 2022-07-08 Easing Tariffs, Not Tensions

- 2022-07-01 Getting Tough

- 2022-06-24 Tools in the Box

- 2022-06-17 Unprecedented Oversight

- 2022-06-10 Squaring Off

- 2022-06-03 Diplomatic Chills

- 2022-05-27 Competing Visions

- 2022-05-20 Common Ground

- 2022-05-13 Bilateral Interests

- 2022-05-06 Vying for Mutual Benefit

- 2022-04-29 Seeking Relief

- 2022-04-22 Tipping Point

- 2022-04-15 “Persistence is Victory”

- 2022-04-08 No Divorce

- 2022-04-01 Auditing Accountability

- 2022-03-25 Playing Policy

- 2022-03-18 One Hand Cannot Clap

- 2022-03-11 Political Forecast

- 2022-03-04 Competitive Advantage

- 2022-02-25 A Sovereign Tightrope