All Eyes on Xi

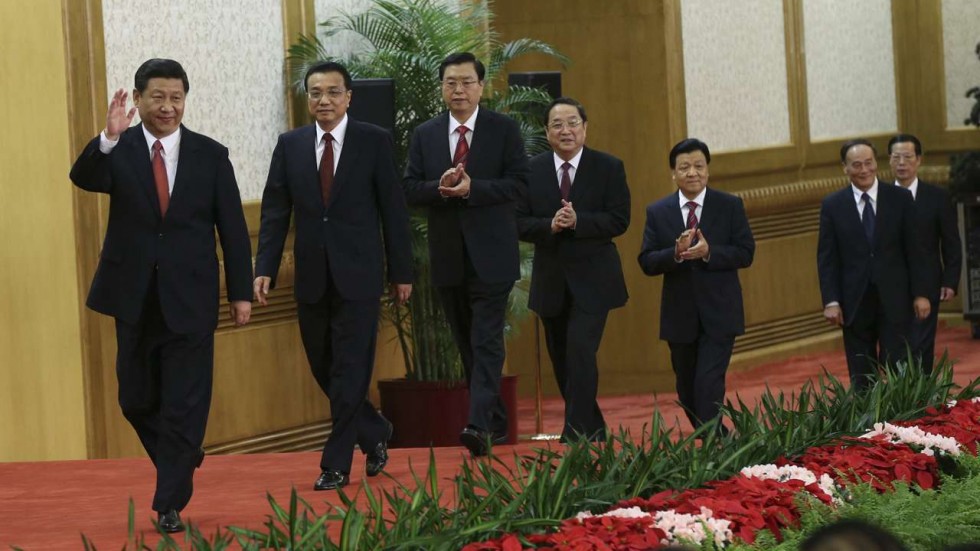

All Eyes on XiChina's 19th Party Congress has finally wrapped up and the much anticipated new leadership was announced. Xi Jinping has been very much the focus of coverage in China, but many were also curious to see which leaders would be elevated to the Politburo Standing Committee (PSC), the Chinese Communist Party's top decision-making body, which would determine the next generation of leadership. The conclusion many have drawn is that there seems to be no obvious successor to Xi Jinping since all the new members are in their 60s -- too old to be groomed in five years given the unofficial retirement age of 68.

Xinhua has listed out all 204 members of the 19th CPC Central Committee, and if you can read Chinese, Xinhua also has run a lengthy piece on the exhaustive process for vetting CPC Central Committee members. At least 152 individuals didn't make it to the short list, which supports the conclusion of some analysts that China is earnestly implementing a meritocratic system of promotion through the party ranks. That said, the meritocratic system has not proven advantageous for women or minorities. As SupChina points out, there are only 10 women and 16 representatives from minority ethnic groups of the 204 Central Committee members.

Lea Shih, a researcher at the Berlin-based MERICS decided that more than factional politics, the most interesting appointments made were the number of aerospace engineering technocrats advanced. She writes: "The rise of the aerospace expert can be explained by the internal power struggles within the CCP. These officials have a certain 'detachment from factional politics,' which makes them more likely to be loyal to the top leadership. But of course loyalty is not enough. The leading officials must also be competent. These aerospace experts have technological know-how, experience with large corporations and extensive administrative management. In comparison with other officials, the technocrats are considered to be goal-oriented, have essential problem-solving skills, and also a willingness 'to make necessary but unpopular decisions.'"

Most of the Anglo press focused on Xi Jinping setting himself up to be the most powerful leader since Mao Zedong, both by adding "Xi Jinping Thought," to the Party's constitution, and in consolidating his power with allies the Politburo. The South China Morning Post has a great intro to the new member's of the new PSC. Also here are short bios of the PSC written by The Financial Times. While each of the member's positions won't be officially decided until next year, the ranking order that the Reuters published is as follows: 1) Xi Jinping, 2) Li Keqiang, 3) Li Zhanshu, 4) Wang Yang, 5) Wang Huning, 6) Zhao Leji, 7) Han Zheng.

Many have commented that Xi's second critical victory at the 19th National Congress was the promotion of two close allies to the Standing Committee, Li Zhanshu, who is his current chief of staff, and Zhao Leji, who has taken over Wang Qishan's role as head of the Central Disciplinary Committee. While talk of succession looks increasingly irrelevant, Quartz took a closer look at the group of 25 Politburo members and identified a few possible successors: Chen Min'er, 56, is considered a protégé of Xi's and a member of the Zhejiang clique, a major component of Xi's faction; Hu Chunhua, 54, is considered a favored leadership candidate by ex-president Hu Jintao; Ding Xuexiang, 55 is considered part of Xi's inner circle.

In The Cipher Brief, Callie Wong writes: "Xi may be simply testing the political waters for a potential extension of his rule and observing how key stakeholders react to the lack of a successor, while still leaving the door open to name one later. Or, Xi may simply be undecided on who he wants to take the mantle of China in five years, wants to limit palace intrigue and minimize the time under which he will be considered a 'lame-duck.'"

The Guo Wengui Saga

The Guo Wengui SagaIn 2014, billionaire real-estate developer Guo Wengui fled to the U.S. after learning that he had been charged with rape, bribery, and kidnapping by the Chinese Government. But until the past month, he was hardly known in the West outside of China-watchers and policymakers who knew how badly Beijing wanted him back on the mainland.

However, following a meeting with Steve Bannon and becoming the alleged victim of a think tank hacking by Beijing, Mr. Guo's story has been catapulted into the spotlight and hailed by the Wall Street Journal as a, "Manhattan Caper Worthy of Spy Thriller." Why the sudden attention? The curious case has come to represent some of biggest rifts and strains between Beijing and the Trump Administration today – as well as the growing tension between Chinese and U.S. values.

Beijing's intentions are as well-defined as their motivations are easy to ascertain. From his tightly-guarded Manhattan penthouse, Mr. Guo's uses his slick social media account as a platform for allegations of wrongdoing against members of the highest levels of the Communist party – even including those within President Xi Jinping's inner circle. Some believe that the amplified pressure to silence Mr. Guo fell into the trend of 'tying up loose ends' before China's 19th Party Congress, which concluded this Wednesday – particularly as he promised to hold a parallel press conference that would "shine light into the black box of elite Party politics."

Perhaps more interesting, however, is how the Trump administration has reacted to amplified pressure from China on the forcible extradition of Mr. Guo. After over a year of diplomatic tensions, Trump has swung between extremes on his willingness to comply with Beijing's interests. Last week, American casino magnate Steve Wynn "hand-delivered a letter to Trump from the Chinese government asking him to ship Guo home… Trump later recalled the letter during an Oval Office briefing on Chinese economic espionage. 'Where's the letter that Steve brought? We need to get this criminal out of the country.'" But days later, headlines reported that Trump decided against deporting the fugitive "after learning that he is a Mar-A-Lago member". Taking a clearer stance, Attorney General Jeff Sessions "went to the mat" against pro-China factions within the Trump administrations to block the forcible return of Guo Wengui, threatening to resign if pressure persisted.

In the wake of much confusion and tension, what remains clear is that Beijing will continue to seek unconventional methods to get through to the U.S.'s most unpredictable leader in its history. Conventional positions, like those being duked out between Sessions and his cohort, will not be the deciding factor for the Commander in Chief.

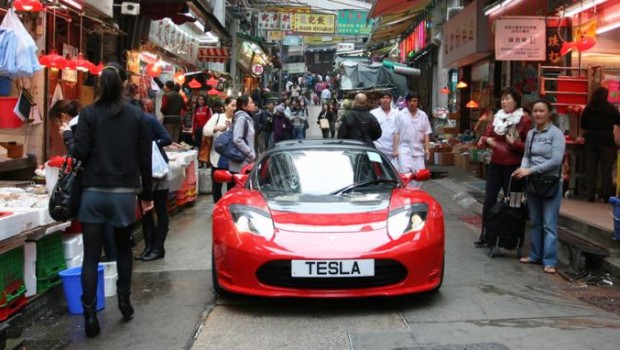

Tesla's Batteries, China's Access

Tesla's Batteries, China's AccessEarlier this week, China's Ministry of Commerce confirmed that it is in talks with Tesla to build a factory in the Shanghai's free trade zone. The automotive giant is now at a crossroads, having to decide if it will launch a joint venture with a local partner, in which it would share profits and likely technology, or if it will own its own plant in the free trade zone - which would subject the company to 25% import tariffs. This move does not come as a large surprise as Tesla, who exported about 13% of its vehicle production to China last year, representing about $1 billion in revenue, is looking to cut costs, with the high automotive import tariff in China being the the main reason for their Chinese export numbers being so low.

This decision by the electric car giant is a small indication of a bigger trend in China of "luring foreign companies into joint ventures by offering access to its giant market." However, it is also speculated by many that the real intention behind such moves is to "create powerful Chinese companies that can hold their own against their foreign counterparts." Further, with China's ambition to ban petrol and diesel cars, coupled with their subsidies on electric vehicles, worth up to $15,000 per vehicle, it is made clear that the intention is to corner the market.

Stepping back, and looking at this single market as a microcosm of China's larger macroeconomic intentions, the obvious picture is painted even more clearly. As the world turns to combatting climate change, one big win for the planet and society will be to reduce carbon emissions emanating from vehicles. This has led to an increase in demand for lithium-ion batteries - the power source for electric cars - and the raw materials needed to produce them. One such resource is cobalt, of which, over 60% of the global supply comes from Congo, with its share in the cobalt market expected to reach as high as 73% by 2025.

Africa, the continent in which Congo is located, is one of the key areas which lies along China's biggest initiatives, the Belt and Road. The rationale behind the initiative is to help countries along the Belt and Road with their infrastructure deficits. Additionally, "by boosting connectivity, China can spur growth in the short term, gain access to valuable natural resources in the mid term and create new booming markets for its goods long into the future." Cobalt will surely be no exception to this, as China looks to connect the African continent to its own market through massive infrastructure projects, including rail lines in Ethiopia to ports in Kenya. By make such investment in hard infrastructure, China will be able to develop "soft infrastructure," which includes intergovernmental agreements, trade deals, customs pacts, and the like. Thus, it is through investing heavily in the Belt and Road initiative, of which China's commitment was further solidified through the inclusion of the Belt and Road Initiative.

This Week in Chinese HistoryOn October 29, 2015, China announced the end of their one-child policy after 35 years. The decision was a dramatic step away from a core Communist Party position that Deng Xiaoping, the Chinese leader who imposed the policy in the late 1970s, once said was needed to ensure that "the fruits of economic growth are not devoured by population growth." The policy allowed exceptions for many groups, including ethnic minorities. In 2007, 36% of China's population was subject to a one-child restriction, with an additional 53% being allowed to have a second child if the first child was a girl. Provincial governments imposed fines for violations, and the local and national governments created commissions to raise awareness and carry out registration and inspection work. Abolishing the one-child policy would "increase labor supply and ease pressures from an aging population," the National Health and Family Planning Commission, which enforces the policy, said in a statement issued after the party meeting. "This will benefit sustained and healthy economic development," the commission said. Yet while the decision surprised many experts and ordinary Chinese, some said it was unlikely to ignite either a baby boom or an economic one.

This Week in Chinese HistoryOn October 29, 2015, China announced the end of their one-child policy after 35 years. The decision was a dramatic step away from a core Communist Party position that Deng Xiaoping, the Chinese leader who imposed the policy in the late 1970s, once said was needed to ensure that "the fruits of economic growth are not devoured by population growth." The policy allowed exceptions for many groups, including ethnic minorities. In 2007, 36% of China's population was subject to a one-child restriction, with an additional 53% being allowed to have a second child if the first child was a girl. Provincial governments imposed fines for violations, and the local and national governments created commissions to raise awareness and carry out registration and inspection work. Abolishing the one-child policy would "increase labor supply and ease pressures from an aging population," the National Health and Family Planning Commission, which enforces the policy, said in a statement issued after the party meeting. "This will benefit sustained and healthy economic development," the commission said. Yet while the decision surprised many experts and ordinary Chinese, some said it was unlikely to ignite either a baby boom or an economic one.

Prepared by China-US Focus editorial teams in Hong Kong and New York, this weekly newsletter offers you snap shots of latest trends and developments emerging from China every week, while adding a dose of historical perspective.

- 2017-10-20 The 19th Party Congress Begins

- 2017-10-13 Tech Titans

- 2017-10-06 China’s Super Golden Week

- 2017-09-29 All Quiet on North Korea’s Western Front?

- 2017-09-22 Back Together and Better than Ever: Renewed Sino-Russian Relations

- 2017-09-15 China positions itself to dominate the industries of the future

- 2017-09-08 Did North Korea just test a hydrogen bomb?

- 2017-09-01 Are Forced Technology Transfers Forcing the U.S. and China to Rethink How They Do Business?

- 2017-08-25 Bannon Out: What now for the China-US relationship?

- 2017-08-18 Trump Launches “Investigation on Whether to Investigate” China’s IP Laws

- 2017-08-11 Threats of "Fire and Fury" on the Korean Peninsula

- 2017-08-04 Trump Administration Plans Trade Actions Against China

- 2017-07-28 Xi to Dominate the 19th CPC Congress

- 2017-07-21 A Steely Comprehensive Economic Dialogue

- 2017-07-14 South China Sea Arbitral Award after One Year

- 2017-07-07 Now is the Trump Honeymoon with China Over?

- 2017-06-30 China Passes New Intelligence Law

- 2017-06-23 The End of China’s Honeymoon with Trump & Diplomatic and Security Dialogue

- 2017-06-16 Climate Change and Reliable Data Dealt Blows

- 2017-06-09 India, Pakistan formally welcomed into the Shanghai Cooperation Organization